Opportunity Awaits

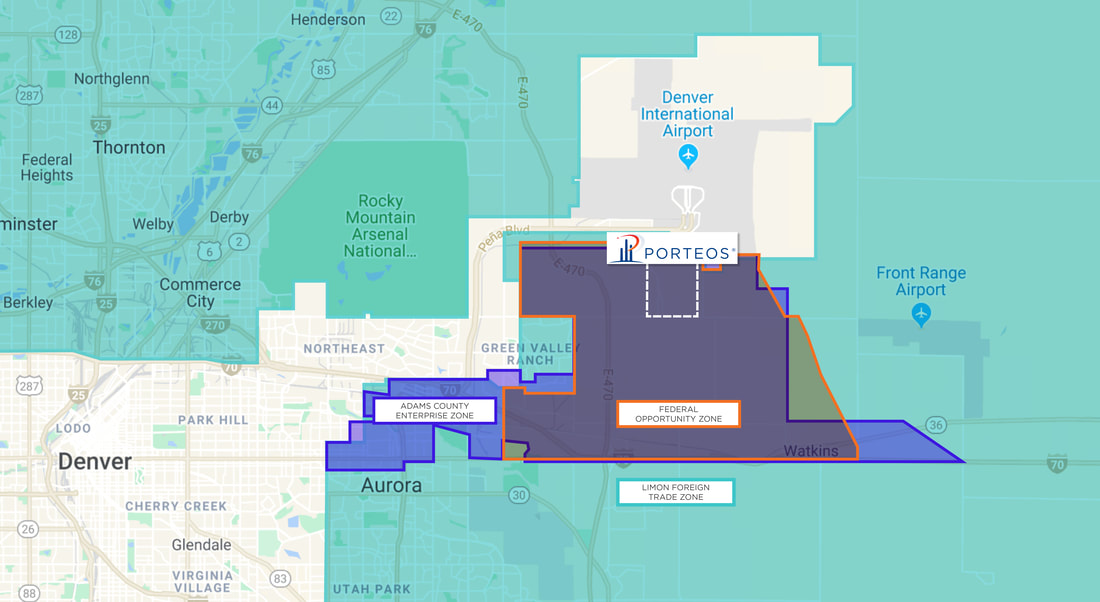

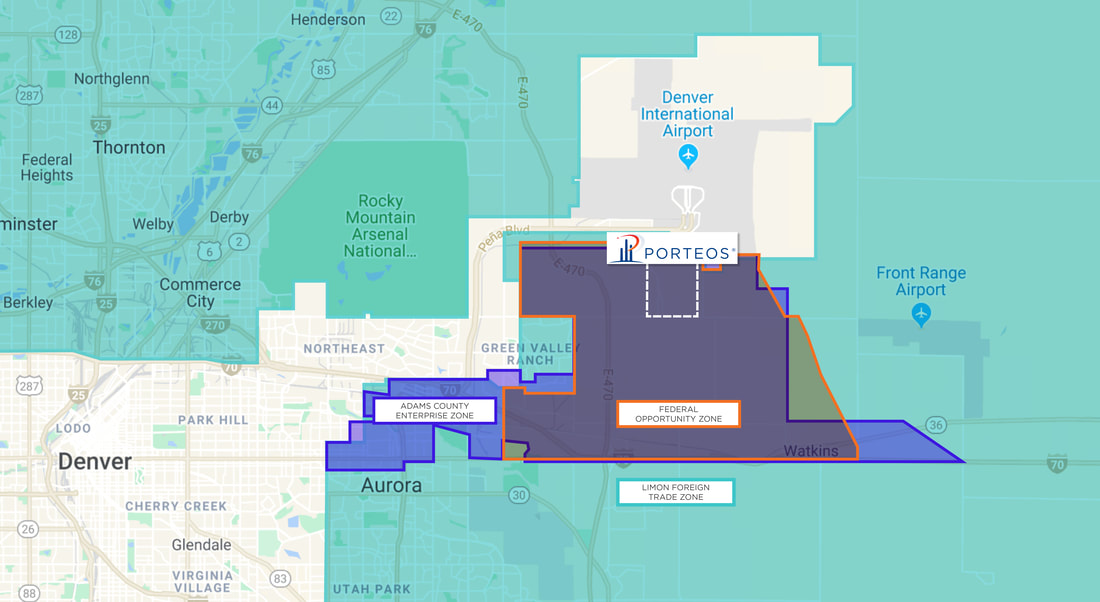

PORTEOS is ideally situated within three diverse economic opportunity zones: the Adams County Enterprise Zone and the Federal Opportunity Zone.

The Federal Opportunity Zone (OZ) program provides a federal tax incentive for investors to invest in low-income urban and rural communities through favorable treatment of reinvested capital gains and forgiveness of tax on new capital gains.

1. Deferral – No up-front tax bill on the rolled-over capital gain and investors can defer their original tax bill until the earlier of a) December 31, 2026 or b) the sale of the Opportunity Zone investment

2. Reduction of tax on the rolled-over capital gain investment for long-term holding.

3. Tax-free appreciation- If an Opportunity Fund investment is held for ten years, the taxpayer pays no capital gains tax on appreciation.

Investment Tax Credit -- 3% tax credit.

Job Training -- 12% of eligible training costs.

EZ - New Employee Credit -- $1,100 per net new employee.

EZ - Agricultural Processor -- Additional tax credit of $500 per net new employee.

EZ - Enhanced Rural Agricultural Processor -- Additional tax credit of $500 per net new employee.

Employer Sponsored Health Insurance -- $1,000 per net new employee insured under a qualified health plan for which the employer pays at least 50% of the cost.

Research and Development Tax Credit -- 3% tax credit.

Vacant Commercial Building Rehabilitation -- 25% credit for the cost of rehabilitation of a building. Limit is $50,000 per building.

Commercial Vehicle Investment Tax Credit -- 1.5% credit of commercial vehicle purchases.

Contribution Projects -- Enterprise Zone (EZ) Contribution Projects encourage community participation and public-private partnerships to revitalize EZs. 25% cash / 12.5% in-kind of donation.

Additional EZ Incentives -- Incentive Amount.